Are you interested in making an investment in the best artificial intelligence ETFs, but are unsure of where to begin? You’re in the correct place, then! We will cover all you need to know about the top Artificial Intelligence ETFs in this in-depth overview. We have you covered whether you’re an experienced investor or are just starting to explore the world of AI. Join me as we start on this interesting journey.

Introduction to AI ETFs

Artificial Intelligence has emerged as a dominant buzzword in both the technological and financial landscapes. However, what exactly are AI ETFs, and why should you think about including them in your financial portfolio? Let’s simplify things so that it may be understood.

What Are ETFs?

Exchange-traded funds, or ETFs, are financial vehicles that hold a diverse assortment of securities like stocks, bonds, or commodities. They are made to monitor an index, industry, or in our instance, Artificial Intelligence’s performance.

In contrast to conventional mutual funds, ETFs are actively traded on stock exchanges, rendering them readily tradable throughout the trading day at market prices. This flexibility and liquidity offer investors a distinct advantage.

Why Invest in AI?

Artificial Intelligence is revolutionizing various industries, spanning from healthcare to finance and beyond. Venturing into AI investments presents the opportunity to participate in the potential growth and innovation within this domain. But why opt for ETFs over individual AI stocks?

The answer lies in diversification. AI ETFs amass a diverse array of AI-related stocks, mitigating the risks associated with individual stock selections. They provide a hassle-free approach to investing in the expansive AI market without staking all your assets on a single bet.

How Do AI ETFs Work?

AI ETFs operate by tracking an underlying index comprising companies deeply entrenched in the AI landscape. These firms encompass players engaged in machine learning, robotics, automation, and AI software development. As the fortunes of these index constituents rise or fall, so does the value of the ETF.

Investors can acquire shares in an AI ETF, akin to the process of purchasing any other stock. This offers a straightforward and accessible avenue for AI investment without the need for exhaustive research or specialized trading expertise.

The Best Artificial Intelligence ETFs

Let’s take a closer look at some of the top AI ETFs in the market. These funds have consistently outperformed the broader market and offer unique features for investors.

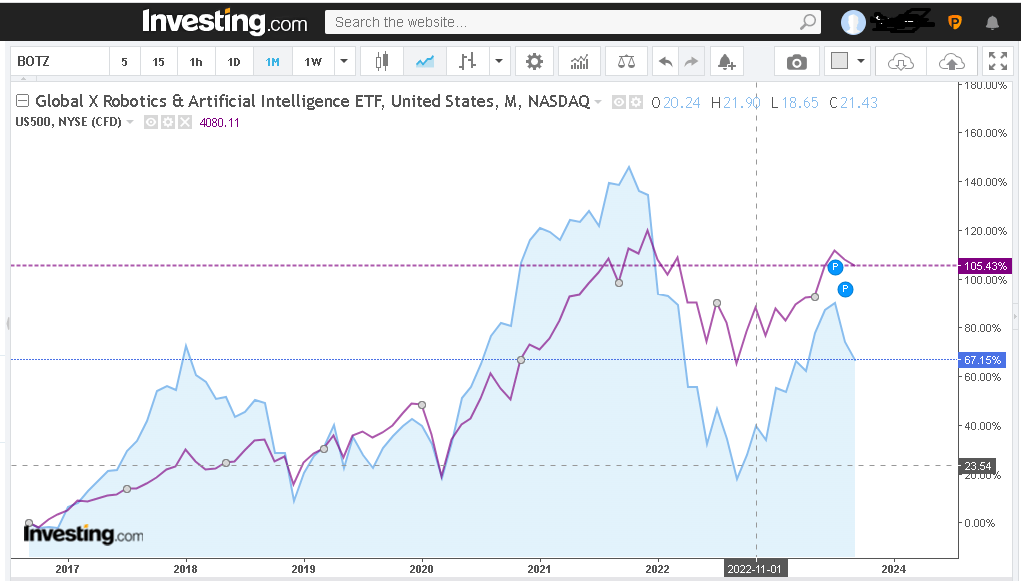

#1. Global X Robotics & Artificial Intelligence ETF(BOTZ)

Expense Ratio: 0.69%

Established in 2016, the Global X Robotics and Artificial Intelligence ETF (BOTZ) focuses on companies involved in robotics and automation, a wise choice for those thinking about the practical benefits of AI. Holding 44 stocks, it aims to benefit from the increased adoption of these technologies.

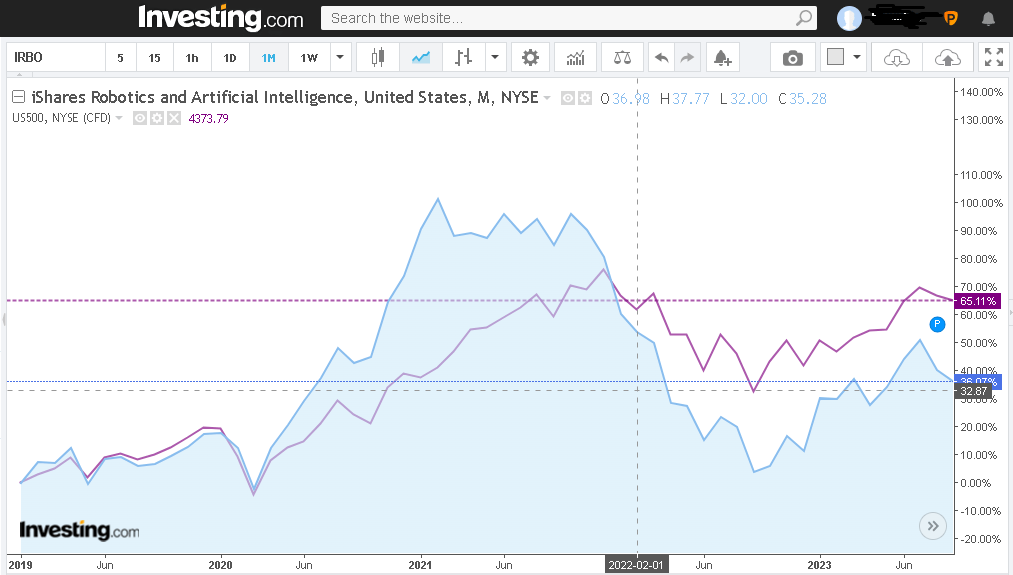

#2. iShares Robotics and Artificial Intelligence ETF(IRBO)

Expense Ratio: 0.47%

With a diverse portfolio of AI and robotics companies, IRBO offers exposure to both established players and emerging innovators. IRBO was established in 2018 and currently manages less than $1 billion in assets. IRBO aims to track an index of companies benefiting from opportunities in robotics and artificial intelligence.

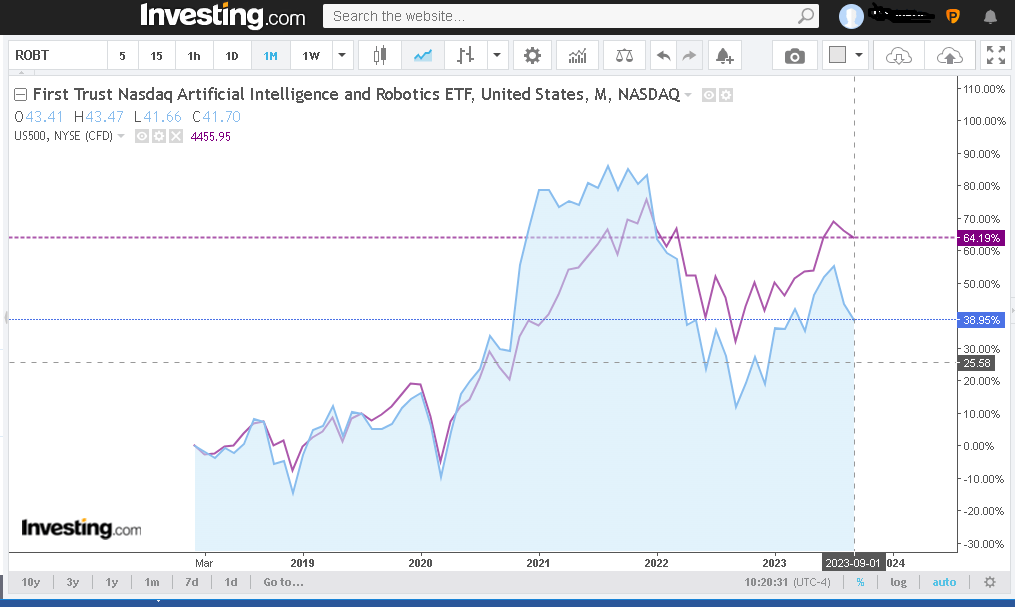

#3. First Trust Nasdaq Artificial Intelligence & Robotics ETF(ROBT)

Expense Ratio: 0.65%)

ROBT tracks the Nasdaq CTA Artificial and Robotics Index, predominantly comprising tech stocks. Its performance surged during the pandemic, driven by its tech-heavy holdings.

The ETF, launched in 2018, increased during the pandemic, in part because of the fact that over sixty percent of its holdings are made up of tech firms.

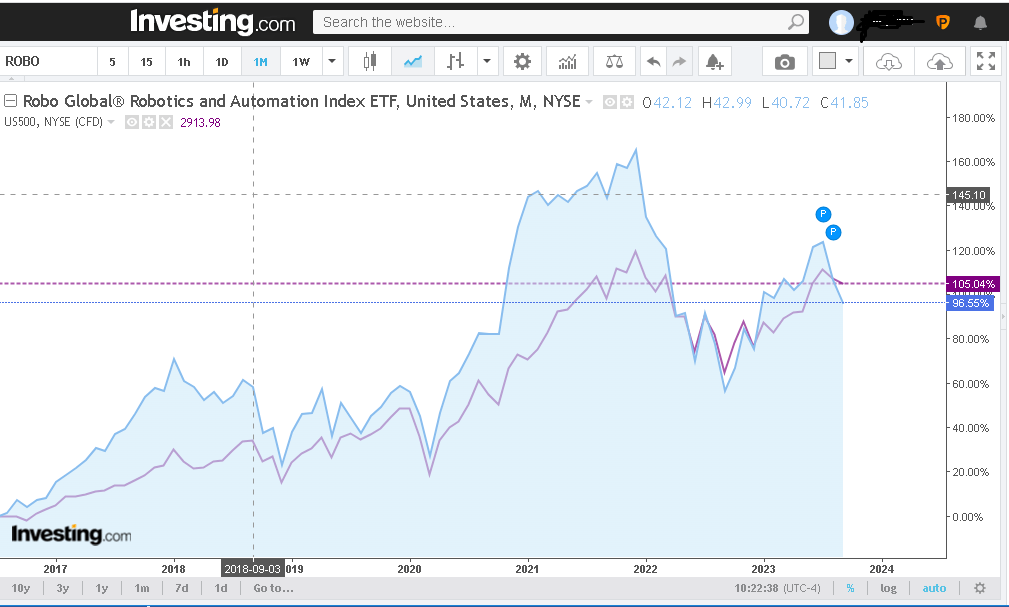

#4. ROBO Global Robotics and Automation Index ETF(ROBO)

Expense Ratio: 0.95%

This ETF centers on companies driving innovations in robotics, automation, and AI. It holds a diversified portfolio with 80 different stocks, with no single holding accounting for more than 2.2% of the ETF’s value. Only about 9% of the fund’s total value is comprised of its top five holdings.

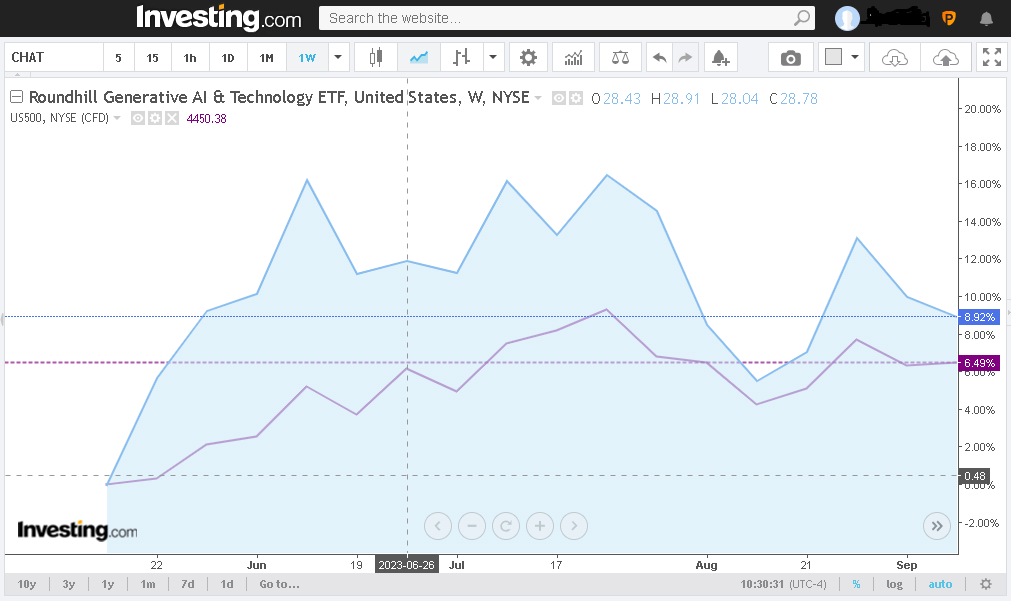

#5. Roundhill Generative AI & Technology ETF(CHAT)

Expense Ratio: 0.75%

Launched in May 2023 Roundhill Generative AI & Technology ETF (CHAT) offers pure-play AI exposure, actively managed to select AI investments. Though relatively new, it concentrates on companies deeply involved in AI solutions.

Nvidia, Microsoft, Alphabet, Baidu Inc. (BIDU), Adobe Systems Inc. (ADBE), and other companies that currently invest, deploy or develop AI solutions, are among CHAT’s top holdings. But remember that this is a relatively young ETF with only $88 million AUM and a 36-stock portfolio. CHAT charges a 0.75% expense ratio.

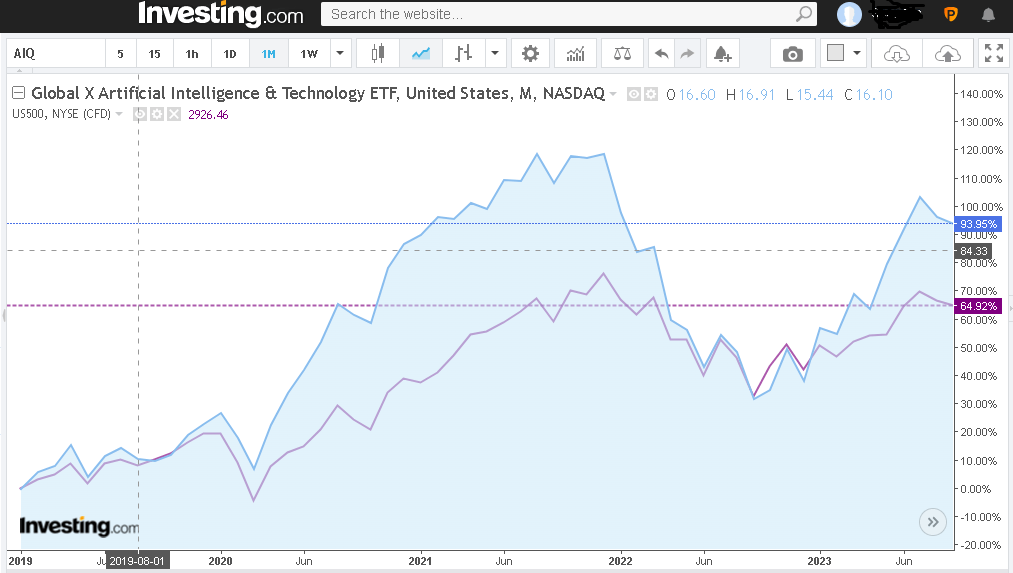

#6. Global X Artificial Intelligence & Technology ETF(AIQ)

Expense Ratio: 0.68%

Global X Artificial Intelligence & Technology ETF (AIQ) tracks the Index Artificial Intelligence & Big Data Index, providing global diversification. Its holdings encompass a variety of AI-related companies.

AIQ now holds 87 globally diversified holdings. Although U.S. equities account for around 65% of the ETF’s portfolio, there is a respectable allocation to Chinese and Korean companies as well as stocks from Germany, Ireland, Canada, and Japan at 9.7% and 4.4%, respectively. The ETF charges a 0.68% expense ratio.

Performance Metrics to Consider

When evaluating AI ETFs, it’s crucial to look beyond the fund’s name and understand its performance metrics:

- Expense Ratio: This is the annual fee you’ll pay to the fund. Lower is generally better.

- Historical Performance: Past performance serves as an indicator but is no crystal ball for the future.

- Asset Under Management (AUM): A larger AUM can indicate that the fund is well-established and trusted by investors.

- Tracking Error: This measures how closely the ETF’s performance aligns with its benchmark index. Lower tracking error is preferable.

Risks and Challenges

Aside from the potential for high profits, investing in AI (Artificial Intelligence) ETFs has a number of dangers and difficulties that investors should be aware of:

- Volatility: Like all investments, AI ETFs can be subject to market fluctuations. Be prepared for ups and downs.

- New Technology Risks: AI is a rapidly evolving field, and what’s considered cutting-edge today may be obsolete tomorrow. Keep a close watch on the holdings of the fund.

- Market Saturation: As interest in AI grows, more funds enter the market. Be selective in choosing the right one for your portfolio.

Diversifying Your Portfolio

Diversification stands as a cornerstone strategy for risk management in your investment portfolio. While AI ETFs offer an attractive option, it’s vital to balance them with other assets such as stocks, bonds, and real estate. This diversification serves as a protective cushion against unforeseen market tumult.

Tax Considerations

Before delving into AI ETF investments, consult with a tax professional. The tax ramifications of ETF investments hinge on individual circumstances and the jurisdiction of residence. Gaining insight into these tax consequences will empower you to make well-informed investment decisions.

Investing Tips and Strategies

Here are some tips to consider as you embark on your AI ETF investment journey:

- Start Small: If you’re new to investing, begin with a small allocation to AI ETFs and gradually increase it as you become more comfortable.

- Stay Informed: Keep up to date with developments in the AI industry and the companies in your chosen ETF.

- Long-Term Perspective: View AI ETF investments as a long-term strategy, steering clear of impulsive decisions influenced by short-term market fluctuations.

- Review Your Portfolio: Periodically assess your investment portfolio and rebalance it as needed to maintain your desired asset allocation.

Conclusion

In summary, investing in the finest Artificial Intelligence ETFs presents a compelling pathway to harness the potential of this transformative technology. By choosing the right ETF and maintaining a comprehensive portfolio for potential growth you can reduce risk and position yourself.

It is important to do research, keep your risk tolerance in mind, and think about your financial goals because one person’s investment approach may not be suitable for others. Let’s now answer some frequently asked questions concerning AI ETFs.

Let’s now answer some frequently asked questions concerning AI ETFs.

FAQs about AI ETFs

Q1. What is the minimum investment required for AI ETFs?

Ans: The minimum investment requirement for AI ETFs can vary depending on the fund. While there is no minimum investment requirement in some ETFs, others may demand several hundred dollars or more. If you are interested in ETF, find out its minimum investment amount.

Q2. Are AI ETFs suitable for beginners?

Ans: Yes, AI ETFs can be suitable for beginners, especially those who want exposure to the AI sector without the complexity of individual stock selection. They offer diversification and are traded like regular stocks, making them accessible to novice investors.

Q3. What are the potential tax consequences when selling AI ETF shares?

Ans: The tax consequences of selling AI ETF shares can vary based on factors like your holding period and tax jurisdiction. In general, you may incur capital gains taxes when selling ETF shares. Consult with a tax advisor for personalized guidance on your tax situation.

Q4. What is the top ETF for artificial intelligence?

Ans: The top ETF for artificial intelligence is generally considered to be the ‘iShares Robotics and Artificial Intelligence ETF (IRBO)’. With a diverse portfolio of AI and robotics companies, IRBO offers exposure to both established players and emerging innovators.

Q5. Does Vanguard have an AI ETF?

Ans: As of my last knowledge update in September 2021, Vanguard did not have a specific AI ETF. However, the investment landscape is continually changing, so it’s a good idea to check Vanguard’s website or a financial news source for any new ETF offerings.

Q6. Which ETF has the most AI stocks?

Ans: The ETF with the most AI stocks can change over time. As of my last knowledge update in September 2021, popular AI-related ETFs include QQQ, BOTZ, and ARKQ. However, I recommend checking the latest information to find the current ETF with the most AI exposure.

Q7. Is there an ETF based on artificial intelligence?

Ans: Yes, there are several ETFs based on artificial intelligence. The Global X Robotics & Artificial Intelligence ETF (BOTZ) and the ARK Autonomous Technology & Robotics ETF (ARKQ) are few of them. These ETFs focus on companies involved in AI and robotics technologies.

Q8. Is AI a good investment in 2023?

Ans: The potential for AI as an investment in 2023 depends on various factors, including market conditions and individual investment strategies. AI continues to be a growing field, and many investors find it promising. However, it is crucial to do thorough research and consider your investment goals and risk tolerance.

Q9. What will AI stock price be in 2025?

Ans: Predicting the exact stock price of AI-related companies in 2025 is challenging. Stock prices are influenced by various factors, including market dynamics, company performance, and economic conditions. Investors should consult financial experts and analyze market trends for more accurate predictions.

Q10. What will AI be worth in 2025?

Ans: The overall worth or market size of the AI industry in 2025 can vary depending on the growth and adoption of AI technologies across various sectors. Industry forecasts suggest that the AI market is expected to continue expanding significantly, but specific figures would require up-to-date research.

The process of investing in AI ETFs is thrilling and could be lucrative. It’s crucial to approach it knowing the dangers, rewards, and your own financial objectives. You can choose the finest Artificial Intelligence ETFs by using the advice and knowledge in this article to help you along the way. Happy investing!

You May Also Like…