Strategic investment is a method that has attracted a lot of interest in the dynamic world of finance. This investment technique entails making well-informed choices after thoroughly reviewing all relevant financial market variables. Strategic investing requires thoughtful thought, detailed preparation, and a thorough understanding of the constantly changing economic landscape.

We will look at the foundations of strategic investing in this article and its advantages, core tenets, and methods for getting started.

What is Strategic Investing?

A proactive approach to managing investments, strategic investing focuses on reaching long-term financial goals. Strategic investors adopt a wider perspective and take into account trends and developments that may have an impact on their investments over a number of years, in contrast to short-term traders who seek to profit from recent market changes.

Key Principles of Strategic Investing

Setting long-term financial objectives, spreading assets across several asset classes, risk management techniques, market analysis and research, as well as adaptability and flexibility, are all aspects of strategic investing. These guidelines help investors make decisions, reduce risks, spot possibilities and problems, and create a favorable investment environment. Investors may traverse ever-changing markets and make wise selections by concentrating on these ideas.

Importance of Strategic Investing

In today’s financial environment, strategic investment is essential since it requires a methodical strategy that takes many elements into account to maximize long-term growth and wealth building. It entails establishing specific objectives, evaluating risks, conducting extensive market research, identifying prospective industries, diversification, tapping into global markets, timing, deciding between long-term and short-term strategies, forming partnerships and networks, utilizing skills, being tax-efficient, and protecting money. Long-term goals are given priority by strategic investors, who shun short-term gains and use cooperative investment strategies.

Types of Strategic Investments

Strategic investments are crucial to creating a safe and prosperous future when it comes to making wise financial decisions. This section will explore several long-term and short-term strategic investment tactics that can assist you in navigating the complex world of finance and achieving your financial objectives.

Long-Term Investment Strategies

- Buy and Hold Strategy: The Buy and Hold Strategy is a tried-and-true investment strategy that entails buying assets, like stocks, and hanging onto them for a protracted length of time. Compounding returns are made available to investors through this technique, which takes advantage of the potential for long-term growth. Investors can weather market ups and downs by taking a patient and consistent approach, with the potential for significant rewards in the long run.

- Dividend Growth Investing: Dividend Increase When investing, the goal is to buy stocks from businesses that have a track record of steadily raising their dividend payments. This method enables investors to profit from possible capital growth in addition to offering a steady stream of income. Reinvesting dividends allows investors to benefit from compounding and grow their money consistently over time.

- Value Investing: The goal of value investing is to locate undervalued assets on the market. This approach is used by investors to find stocks that are undervalued by carefully examining financial measures and fundamentals. Investors position themselves for potential future gains by purchasing these companies at a discount, positioning themselves for when the market corrects and the stock’s actual value is realized.

Short-Term Investment Strategies

- Swing Trading: A short-term financial strategy called swing trading exploits price ” swings ” or market fluctuations. Swing traders often hold positions for a couple of days to a couple of weeks with the intention of profiting from swift price changes. With the help of this approach, traders can take wise judgments and generate quick gains by having a thorough understanding of technical analysis and market patterns.

- Day Trading: Buying and selling financial products on the same trading day is known as day trading. Day traders take advantage of short-term price changes in an effort to profit from choppy market circumstances. This strategy demands quick decision-making, moderation, and a solid understanding of market signals. Despite the potential benefits, day trading involves inherent risks and requires strict risk management.

- Momentum Investing: Finding assets with substantial upward price momentum is the focus of momentum investing. Investors who use this technique think that assets with a strong recent performance will probably continue to rise. Even though it has the potential to be profitable, momentum investing requires constant attention to market movements and rapid trade execution to maximize profits and minimize risks.

Benefits of Strategic Investing

Strategic investment has become a critical strategy for anyone looking to safeguard their financial future in today’s fast-paced financial environment. By emphasizing long-term objectives, risk reduction, and total portfolio diversity, this approach goes beyond conventional investment. The benefits of strategic investing, such as wealth creation, risk management, portfolio diversification, tax efficiency, and the achievement of financial goals, will be discussed in this section.

Wealth Accumulation: Growing Your Financial Potentials

The possibility of building considerable wealth is at the heart of strategic investing. Investors can benefit from the power of compounding by choosing high-performing assets and holding them for a long time. Due to the compounding effect, gains are amplified over time, enabling even little investments to grow into significant sums. Strategic investors pick carefully and keep assets that are in line with their financial objectives while enduring market changes and taking advantage of their investments’ upward trend.

Risk Management: Safeguarding Your Investments

Risk management is included as an important element in strategic investing. Investors strategically spread their wealth across other types of assets rather than putting all their eggs in one basket. Diversity acts as a safety net to ensure that progress in one area outweighs harm in another. Investors can effectively lower their portfolio’s total risk exposure through diversification, increasing the portfolio’s resistance to market volatility and unanticipated economic downturns.

Diversification of Portfolio: Broadening Your Investment Horizons

Strategic investing’s cornerstone is diversification. Investors reduce the effects of subpar performance in any one asset by diversifying their investments across many industries, sectors, and geographical areas.This approach enhances risk management and at the same time provides plenty of opportunities for career advancement to the user. A diverse portfolio is better positioned to withstand market shocks and profit from new trends, whether the investments are stocks, bonds, real estate, or alternative ones.

Tax Efficiency: Optimizing Your Financial Returns

Tax efficiency is a crucial aspect of strategic investing. Investors can reduce their tax obligations and keep more of their investment gains by using strategies like tax-loss harvesting and using tax-advantaged accounts. Investors can more effectively compound their profits over time by using this optimization, which will hasten the growth of their portfolio as a whole.

Read More…

Achieving Financial Goals: Turning Dreams into Reality

Strategic investment has the potential to assist people in reaching their financial objectives, which is one of its most alluring features. Strategic investment offers a path for materializing goals, whether they be to finance a happy retirement, buy a home, or fund higher education. Investors can get a little bit closer to their goals every year by setting specific goals, developing a clear investment strategy, and persistently following them.

Strategic Investing for Different Goals

In today’s fast-paced world, financial planning has become an important component of securing our future. The best way to ensure financial security and achieve various life goals is strategic investment. A well-planned investment strategy can help you achieve your goals, whether they be capital development, asset protection, retirement savings, or paying for college.

Not everyone has the same goals while investing. Rather, it is a personal journey that varies according to personal financial objectives. Understanding your goals, determining your risk tolerance, and developing a plan to reach them quickly is part of strategic investing.

Read More…

- Master Your Finances and Thrive: Navigating Your Relationship with Money

- Is Smart Money Concept a Good Strategy? Exploring Financial Wisdom

Retirement Planning: Investing for Golden Years

A significant milestone like retirement calls for thoughtful planning. For a happy retirement, you may need to create a diversified portfolio that should include retirement accounts such as 401(k)s and IRAs, equity bonds, etc. One of the most important aspects of retirement investing is choosing an investment that gives stable returns over time.

Read More…

- Unlocking Your Retirement Dreams: Retirement Countdown

- Master Retirement Planning with a Dollar Cost Averaging Calculator

- Social Security Mistakes: Are You Making These Costly Errors?

Education Fund: Nurturing Future Minds

A future investment is a future investment in education. Creating a special education fund might give your kids or grandchildren a jump start on their academic careers. You should consider custodial accounts, 529 plans, and education savings accounts (ESA).

Wealth Preservation: Safeguarding Your Legacy

A balanced strategy is needed to preserve wealth for future generations. Some investments that can protect funds from market volatility as well as generate a steady income stream include real estate, annuities, and life insurance.

Capital Growth: Expanding Your Financial Horizons

Seeking possibilities for your investments to increase in value over time is known as capital growth. Stocks, exchange-traded funds (ETFs), and mutual funds have the potential to enjoy significant capital growth despite having a high level of risk.

Creating a Strategic Investment Plan

Building wealth and ensuring your financial future both require investing. But if you don’t have a clear plan, your immediate reaction may give the wrong result. A strategic investment strategy can act as a roadmap to deal with the complexities of financial markets and help you determine the best action for your specific circumstances.

Setting Investment Goals

Setting clear and attainable investment goals is the cornerstone of any successful investment journey. These objectives act as compass points that assist you in choosing the reason for your investments. Having clear goals will help your investment approach, whether you’re saving for retirement, long-term growth, or another significant life event.

Asset Allocation

Asset allocation is one of the essential aspects of managing a portfolio. Its main objective is to balance risk and reward by dividing the assets of the portfolio according to an individual’s goal, risk tolerance, and investment horizon.

Research and Analysis

An essential component of a strategic investment plan is informed decision-making. It is essential to conduct an in-depth study and analysis of potential investment prospects. Investigate a company’s finances, examine market trends, and take into account macroeconomic issues that can affect your investments. This extensive research will improve your ability to make informed investment decisions and take advantage of opportunities suited to your plan.

Regular Portfolio Review

A strategic investment strategy requires frequent scrutiny and adjustment as it is not static. You can assess its success by periodically evaluating your investment portfolio and making necessary improvements.

By setting clear objectives, diversifying your assets, doing in-depth research and regularly evaluating your portfolio, you can successfully navigate the world of investing and work towards realizing your financial goals.

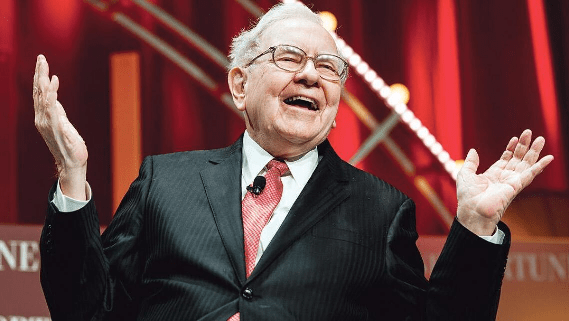

Warren Buffett’s Successful Strategic Investments

Case Study 1: Apple Inc. – Warren Buffett’s Strategic Investment

Value investing and a focus on long-term value development are typically linked to Warren Buffett’s investment strategy. The most important example of his successful strategic investments is his relationship with Apple Inc.

Buffett’s group of companies, Berkshire Hathaway, started making investments in Apple in 2016. Earlier, he had preferred investing in companies with a solid and clear business plan, which was usually lacking in technology startups. Buffett did acknowledge Apple’s robust brand, devoted client base, and reliable cash flow generation, though. Instead of being a standard tech company, he perceived it as a consumer goods company with a technological component.

To show his confidence in Apple’s long-term prospects, Buffett strategically invested in the company. He attached high importance to the ability of the business to produce large-scale cash flows, competitive positioning and an ecosystem of products and services. Berkshire Hathaway currently owns a large share of Apple after gradually increasing its ownership in the business.

The investment was very profitable. Since Berkshire Hathaway’s original investment, which was cut off in September 2021, Apple’s stock price has increased dramatically. This profitable strategic investment serves as an example of Buffett’s ability to adapt his investment philosophy to the changing realities of the market while maintaining his core value investing idea.

Case Study 2: Coca-Cola –A Perfect Example of Buffett’s Investment Intelligence

Warren Buffett’s long-term investment in the Coca-Cola Company is another example of the way he made strategic investments. Buffett made his first investment in Coca-Cola stocks in the late 1980s and early 1990s.

The fact that Coca-Cola is a well-known and recognized brand matches Buffett’s emphasis very well on investing in businesses with a sustainable competitive advantage. Strong product demand, global presence, and the company’s extensive distribution network helped generate substantial cash flows and dividends.

Buffett’s investment in Coca-Cola is a perfect example of his focus on long-term holding and compounding. He saw the potential for a company that could consistently make profits, increase dividends, and increase shareholder wealth. Despite the shifting beverage industry and worries about health trends that may harm sugary drinks, Coca-Cola has retained its status as a successful investment for Berkshire Hathaway thanks to its strong brand recognition and adaptability to shifting customer tastes.

Buffett’s strategic investments in Apple and Coca-Cola demonstrate his readiness to stray from conventional value investing criteria when he spots a compelling opportunity with a solid business foundation and the potential for long-term growth.

It is important to note that the results of these investments will be influenced by past performance and market conditions. The results of these investments could be impacted by future changes. Always do a thorough study and analysis before making any investment decision.

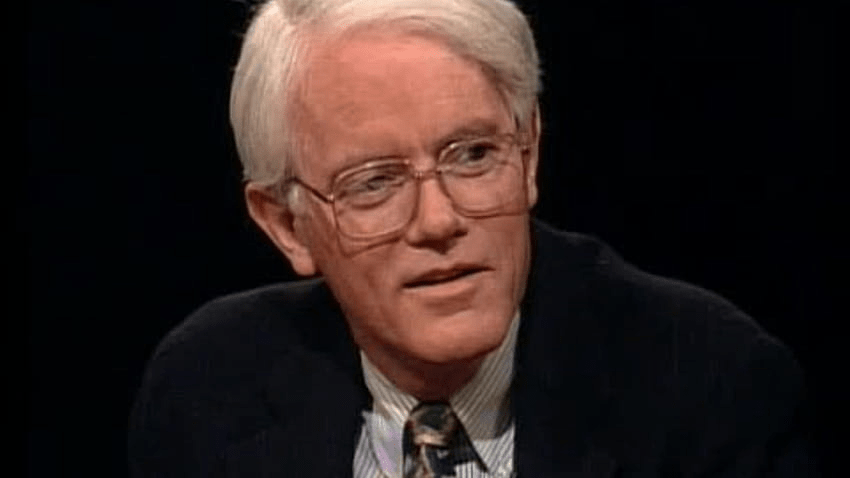

Peter Lynch’s Investment Philosophy

One of the most successful and important investors in history is acknowledged as Peter Lynch. His approach to investing is based on extensive study, a long-term outlook, and a solid grasp of the businesses he invests in. Lynch’s strategy is frequently summed up as “invest in what you know,” and he is renowned for his capacity to spot lucrative investment possibilities by keeping an eye on commonplace consumer patterns and behavior. Let’s look at several case studies that demonstrate Lynch’s approach to investing.

Case Study 1-The Dunkin’ Donuts Story:

While traveling around with his wife and noticing long lines at drive-thrus, Peter Lynch is credited with discovering Dunkin’ Donuts. Recognizing the potential of this expanding trend in fast food and coffee consumption, he did more study on the business and discovered that it had a solid business strategy, steady development, and a committed following of clients. Lynch’s investment in Dunkin’ Donuts (now Dunkin’) turned out to be quite successful as the business kept growing and gaining market dominance in the coffee and breakfast sectors.

Case Study 2-The Ford Motor Company:

Lynch’s investment in Ford is a perfect example of the concept of “investing in what you know.” He became interested in the company’s financial situation and growth possibilities after observing that his own family and friends preferred Ford vehicles. His investigation revealed that Ford was developing new products and adapting to changes in the market, which increased its market share and profitability. During a time of recovery for the automobile industry, Lynch’s investment in Ford produced large gains.

Case Study 3-The Fidelity Magellan Fund:

Lynch’s position as the Fidelity Magellan Fund’s manager is another illustration of his track record of successful investments. From 1977 until 1990, under his direction, the fund produced exceptional returns, routinely exceeding the market. In-depth research, a focus on businesses with competitive advantages, and a readiness to hold onto investments for a long time were all part of Lynch’s strategy. His aptitude for seeing expansion prospects across a range of industries, including technology, retail, and finance, played a part in the fund’s successful track record.

Case Study 4-The Home Depot:

Lynch’s investment in Home Depot is proof that he is knowledgeable about consumer trends and behavior. He observed the trend towards DIY home renovation projects and saw an opportunity for a business that catered to this market. Lynch’s investment criteria were in line with The Home Depot’s strong management team, effective operations, and customer-focused strategy. His decision to invest in the company when it was still young was crucial to his success as an investor.

Case Study 5-The Philip Morris Companies (now Altria Group):

Lynch has shown his capacity to recognize the potential in businesses that others might pass over by investing in Philip Morris. Lynch recognized Philip Morris as an important operator with strong cash flow and a loyal customer base despite the ethical dilemmas associated with the tobacco industry. He was aware of how addicting cigarettes were, as well as how the business could consistently turn a profit. His unconventional investing strategy paid off since Philip Morris generated large returns over time.

Briefly stated, Peter Lynch’s “invest in what you know” investment ethos and meticulous research methodology produced a number of successful strategic investments. His illustrious career was built on his aptitude for seeing market trends, comprehending customer behavior, and performing long-term company analyses. The aforementioned case studies show how Lynch’s theories might be used to locate and seize on attractive investment opportunities.

Real-Life Examples of Strategic Investment Success

Success stories provide encouragement for potential investors in the dynamic world of investments. The examples that follow show how strategic choices have produced significant gains, changed whole industries, and elevated businesses to new heights. Here are a few actual instances of successful strategic investments:

The Power of Early Adoption: The Success Story of Apple

Apple is a prime example of the value of early adoption. Apple started concentrating on personal electronics in 2001, which completely changed the technology sector. They were able to achieve this by investing in cutting-edge goods like the iPod, iPhone, and iPad.

Betting on Innovation: Amazon’s Diversification Triumph

Beyond e-commerce, Amazon strategically broadened its product offerings. Due to significant investments made by Amazon in creating a vast fulfillment network, cloud computing services (Amazon Web Services), and market expansion, the company has dominated e-commerce and grown to be a major player in the technology industry.

Sustainable Future: Tesla’s Visionary Investment in Electric Cars

Tesla took a significant risk on electric automobiles when opponents questioned their viability. Strategic investments in battery technology and renewable energy sources have increased customer acceptance of electric vehicles, which has transformed the automotive industry. Tesla’s early investments in high-performance electric vehicle production as well as renewable energy storage have made these improvements possible.

The Financial Sector Marvel: Warren Buffett’s Berkshire Hathaway

Warren Buffett’s expertise as an investor helped Berkshire Hathaway grow into a conglomerate with a variety of enterprises. Over the years, Warren Buffett’s investment approach, which focuses on long-term value and quality companies, has achieved great success. In particular, his investments in businesses such as American Express and Coca-Cola have generated large returns.

Cryptocurrency Revolution: The Case of Bitcoin

A paradigm shift in finance was brought in by the development of Bitcoin. Early adopters who saw its potential were rewarded handsomely as Bitcoin’s value soared over time.

Alphabet Inc. (GOOGL):

Google has strengthened its position as a leader in the tech industry and produced significant income because of its strategic investments in search technology, online advertising, and acquisitions like YouTube.

Retail Resilience: Walmart’s Global Expansion Strategy

Walmart established its position as the leading international retailer through strategic acquisitions and growth. The company remained adaptable in a market that was constantly evolving because to its strategic investments in supply chain management and e-commerce.

Pharma Gamble: Johnson & Johnson’s Imprudent Acquisition

Johnson & Johnson’s stability and steady expansion as a top healthcare organization have been facilitated by its different investment strategies in medicines, medical devices, and consumer healthcare goods.

Starbucks Corporation (SBUX):

Starbucks’ iconic stature and broad success can be attributed to its deliberate growth into international markets, emphasis on the customer experience, and advances in mobile payment and loyalty programs.

These real-life examples of successful strategic investments highlight the value of logical reasoning, foresight, and adaptation in the financial industry. Each tale illustrates a significant lesson about the benefits of making thoughtful and measured investment decisions.

Risks and Challenges in Strategic Investing

Strategic investing can result in substantial benefits, but there are also risks and challenges involved. Making long-term decisions in order to attain specified financial objectives is known as a strategic investment. It includes a variety of financial methods, such as portfolio diversification, sector rotation, and asset allocation. Even the best-planned methods, though, can run into a number of difficulties and dangers.

Volatility and Market Fluctuations

The inherent volatility of financial markets is one of the biggest obstacles to strategic investing. Asset prices can alter dramatically in response to economic information, geopolitical developments, or shifts in market opinion. An investment portfolio’s value may be impacted by these swings, which could result in unpleasant losses.

Economic Uncertainty and Business Cycles

For investors, economic uncertainty is a regular companion. Recession, slow economic growth, and changes in the business cycle can all have an impact on investment plans. One must have a solid understanding of macroeconomic trends and the adaptability of shifting investment allocations.

Regulatory and Compliance Risks

Investment decisions can be greatly impacted by the regulatory environment. Uncertainty can be caused by and have an impact on the profitability of investments by changes in tax laws, financial regulations, or industry-specific standards. For strategic investors, staying current on changing rules is essential.

Liquidity Constraints

Challenges may arise from illiquid assets, especially in market downturns. It might be challenging to quickly leave positions in real estate, private equity, and some alternative assets if there are no immediate buyers available. This lack of liquidity might make it difficult for investors to successfully rebalance their holdings.

Geopolitical and Geo-economics Risks

Global situations like trade tensions or geopolitical crises can have profound effects on the financial markets. These risks have the potential to alter supply chains, affect consumer demand, and increase market uncertainty—all of which can affect the performance of investments.

Technological Disruptions

Technology advancements have the power to disrupt firmly established business structures and transform entire industries. Strategic investors must evaluate the potential effects of emerging technology on the businesses and industries they invest in.

Currency and Exchange Rate Fluctuations

Currency changes can have a big impact on returns for investors who have exposure to other countries. Gains or losses on international investments can be amplified by exchange rate volatility, creating an additional layer of risk.

Risk of Poor Diversification

A lack of diversification might expose a portfolio of investments to concentration risk. If a particular industry underperforms, failing to diversify investments across multiple asset classes or industries might cause losses to be more pronounced.

Managerial and Operational Risks

Investors in businesses must take managerial skill and operational risk into account. The value of a firm can be diminished and investment returns might be impacted by poor leadership, poor management, or inefficient operations.

Environmental, Social, and Governance (ESG) Factors

Investors are becoming more and more interested in ESG factors. Investors may be exposed to reputational and financial risks if environmental, social, and governance practises are not taken into account.

Inadequate Due Diligence

Poor investing decisions may result from a lack of proper research and due diligence. Strategic investors must carefully evaluate possible investments’ financial stability, market position, and growth possibilities.

Behavioral Biases and Emotional Decision-Making

Investment choices can be influenced by human psychology. The long-term strategic strategy may be deviated by impulsive acts brought on by emotional responses to market movements.

Lack of Access to Information

Making wise financial decisions requires having access to accurate and timely information. Effective opportunity and risk assessment might be hampered by a lack of access to credible data.

Although there is the potential for substantial gains, strategic investing is not without its difficulties. Successful investors understand how crucial thorough research, risk analysis, and continuing portfolio management are. Investors can successfully negotiate the complicated world of strategic investing and attain their financial objectives by maintaining their knowledge, diversifying their portfolios appropriately, and responding to shifting market conditions.

Tools and Resources for Strategic Investing

Both art and science go into investing. Successful investors are aware of how critical rigorous investigation and analysis are. In order to help you on your path to strategic investing, we’ve put together a list of useful tools and sources that can give you the advantage you need to make wise choices.

The Power of Data: Stock Screeners

For investors, stock screeners act as treasure maps that can help you find prospective treasures in the huge sea of stocks. You may filter companies using these tools based on a number of factors, including price, market capitalization, dividend yield, and more. You may quickly reduce your selections and concentrate on the stocks that are consistent with your investment objectives by using stock screeners.

Staying Informed: Financial News Sources

Maintaining up-to-date knowledge of the most recent financial news is essential in the quick-paced world of investment. Insights into market trends, corporate performance, economic indicators, and geopolitical events that may affect your investments are provided by reputable financial news sites. By being informed, you may make appropriate portfolio modifications and take advantage of new opportunities.

Community Insights: Investment Forums and Communities

In strategic investing, the wisdom of the crowd can be a very useful tool. You can interact with other investors, exchange ideas, and learn from various viewpoints by joining investment forums and communities. These forums give people a place to talk about stock assessments, investment tactics, and market trends. Prior to taking on any suggestion, keep in mind that you should critically assess the information and conduct your own research.

Technology at Your Fingertips: Investment Software and Apps

Technology has completely changed how we invest in the age of the internet. From portfolio tracking and performance analysis to real-time market data and trading capabilities, investment software and apps offer a variety of services. You can easily make informed decisions with the help of these tools and manage your finances while on the road.

Utilizing the appropriate tools, expertise, and analysis are necessary for strategic investing. You may confidently traverse the complicated world of investing by utilizing the capabilities of stock screeners, financial news sources, investment forums, and technology-driven applications. Since there is no one strategy that can work for everyone, you should keep learning and adjust your strategy as needed.

Conclusion

Strategic investing is not just a money-saving strategy; It is a way of thinking that modifies the way you build wealth. By embracing the benefits of strategic investing, including better diversification, compound returns, educated decision-making, risk management, flexibility, and psychological well-being, you position yourself to not only achieve maximum returns but also long-term financial success. Remember that investing is only part of the answer; Strategic investment is the key.

The integration of strategic investing into your financial path calls for commitment, knowledge, and a long-term outlook. Keep in mind the hidden advantages of strategic investing as you set out on your adventure, and watch as your investment portfolio grows in ways you never imagined possible.

You May Also Like…