Welcome to the in-depth information on how to make $100 a Day Trading Cryptocurrency. Because cryptocurrency trading has become more popular recently, investors now have the chance to profit from the unpredictable nature of digital assets. On this page, you may discover comprehensive instructions on how to utilize and navigate the bitcoin market.

What is Cryptocurrency Trading?

Digital assets are bought and sold on various online platforms known as cryptocurrency exchanges when someone is trading cryptocurrencies. These exchanges enable users to swap cryptocurrencies for fiat money, such as the US dollar or euro, as well as for other cryptocurrencies. In order to profit from price changes, trading needs to be profitable.

Is it Possible to Make $100 a Day Trading Cryptocurrency?

Yes, Cryptocurrency trading does provide the potential to earn $100 a day, but doing so requires a sound trading strategy, risk management, and ongoing learning.

Understanding the Basics

Understanding the fundamental ideas and jargon used in bitcoin trading is crucial before starting. You should understand the following terminology:

- Cryptocurrency: A digital or virtual form of currency that uses cryptography for secure financial transactions.

- Blockchain: A decentralized and distributed ledger technology that records all cryptocurrency transactions across multiple computers.

- Wallet: A digital wallet that stores your cryptocurrency holdings and allows you to send and receive digital currencies.

- Public and Private Keys: Public keys are used to receive cryptocurrency, while private keys are required to access and manage your wallet.

- Liquidity: The ease of buying or selling a cryptocurrency without causing significant price movements.

- Market Orders: Buying or selling cryptocurrencies at the current market price.

- Limit Orders: Setting a specific price at which you want to buy or sell a cryptocurrency.

The Most Recommended Cryptocurrency

Given the abundance of cryptocurrencies accessible, selecting the right one for trading is essential. The following considerations should be made when selecting cryptocurrencies:

- Market Cap and Volume: Look for cryptocurrencies with substantial market capitalization and trading volume.

- Project and Team Behind the Cryptocurrency: Research the project’s goals, technology, and the team members involved.

- Community and Social Media Presence: Check the level of community engagement and active social media presence.

- News and Events: Stay updated on recent news and events that could affect the price of a specific cryptocurrency.

- Price Volatility: More trading possibilities may be available with higher volatility, but there are also more risks involved.

Opening a Trading Account

Before you can start trading cryptocurrencies, you must register for an account with a trustworthy cryptocurrency exchange. Follow these steps to get started:

- Choose a Reliable Exchange: Choose a trusted bitcoin exchange based on your research and trading requirements.

- Sign Up and Complete Verification: Open an account on the exchange of your choice, then finish the required verification steps.

- Secure Your Account: Set a strong password and enable two-factor authentication to increase the security of your account.

- Deposit Funds: Deposit funds into your trading account using supported deposit methods.

- Familiarize Yourself with the Trading Platform: Spend some time learning about the trading platform’s features and capabilities.

How to Create a Trading Plan

A carefully considered trading strategy is crucial for long-term trading success in the bitcoin market. The following are the crucial phases of developing your trading strategy:

- Define Your Goals: Identify your cryptocurrency trading short-term and long-term financial objectives.

- Choose Your Trading Style: Choose between day trading, swing trading, and long-term investing.

- Technical Analysis: Acquire knowledge about and put into practice technical analysis methods to find potential entry and exit points.

- Fundamental Analysis: Take into account the fundamental elements that can affect a cryptocurrency’s price.

- Risk Management: Determine your level of risk tolerance and create a strategy to control and reduce any losses.

Technical Analysis Tools

To analyze price trends and make wise trading decisions, technical analysis tools are essential. Here are a few well-liked technical analysis tools for trading cryptocurrencies:

- Candlestick Charts: Visual representations of price movements that display open, high, low, and close prices for a specific time period.

- Moving Averages: Calculations of average prices over a specified number of periods to identify trends and potential support/resistance levels.

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Bands plotted above and below the moving average to indicate price volatility and potential reversal points.

- Fibonacci Retracement: A tool used to identify potential support and resistance levels based on the Fibonacci sequence.

Fundamental Analysis in the Trading of Cryptocurrencies

Fundamental analysis is assessing the underlying reasons that can affect a coin’s value as opposed to technical analysis, which concentrates on price trends. The following are some elements of fundamental analysis:

- Current events: Keep up with cryptocurrency-related news, announcements, collaborations, and regulatory developments

- Team and Partnerships: Assess the experience and expertise of the team behind the cryptocurrency project and analyze potential partnerships.

- Technology and Innovation: Consider the cryptocurrency’s use of technology and innovation as well as its possible effects on the market.

- Adoption and Use Cases: Consider the adoption rate and real-world use cases of the cryptocurrency.

- Market Attitude: Keep an eye on the general attitude of the market towards cryptocurrencies as well as any outside influences that might have an effect.

Risk Management and Stop Loss Orders

Risk management is crucial when trading cryptocurrencies to safeguard your capital. The stop-loss order is a useful risk management tool. This is how it goes:

- Set Your Risk Tolerance: The maximum amount you are willing to lose on a single trade should be determined.

- Implement Stop Loss Orders: Place a stop loss order to automatically sell your cryptocurrency if it reaches a certain price level.

- Trailing Stop Loss: Adjust the stop loss order price as the cryptocurrency price moves in your favor to secure profits and limit potential losses.

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and the potential reward-to-risk ratio.

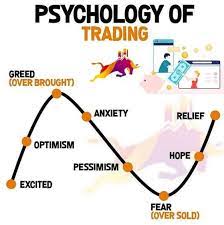

Emotional and psychological trading

Successful bitcoin trading is significantly influenced by trade psychology. Here are some pointers for controlling your emotions and keeping a focused attitude and disciplined mindset:

- Emotion Control: Avoid making impulsive decisions based on fear, greed, or FOMO (fear of missing out).

- Stick to Your Trading Plan: Follow your predetermined trading strategy and avoid deviating from it.

- Learn from Mistake: Analyze your trading errors and take away what you can from them to make better choices in the future.

- Take Breaks: Give yourself regular breaks to avoid burnout and make clear-headed trading decisions.

- Continuous Learning: Stay updated on market trends, new trading strategies, and industry developments.

Day Trading vs. Swing Trading

Two well-liked methods of trading cryptocurrencies are day trading and swing trading. These trading approaches are contrasted here:

- Day Trading: Day traders execute multiple trades within a single day, aiming to profit from short-term price fluctuations.

- Swing Trading: Swing traders hold positions for a few days to weeks, capitalizing on medium-term price movements.

- Time Commitment: Day trading requires more time and attention, while swing trading allows for a more relaxed trading schedule.

- Risk and Reward: Day trading can involve higher risks due to frequent trades, while swing trading offers the potential for larger profits with fewer trades.

- Personal Preference: Choose the trading style that aligns with your personality, lifestyle, and trading goals.

Cryptocurrencies Exchange and trading platforms

A satisfying and simple trading experience depends on selecting the best Bitcoin exchange and trading platform. Here are a few well-liked choices to think about:

- Binance: A leading global cryptocurrency exchange offering a wide range of cryptocurrencies and advanced trading features.

- Coinbase: A user-friendly platform that supports various cryptocurrencies and provides a secure wallet for storage.

- Kraken: A reputable exchange with advanced trading tools and high liquidity for popular cryptocurrencies.

- Bitfinex: Known for its advanced trading interface and features like margin trading and lending.

- KuCoin: An exchange that offers a diverse selection of cryptocurrencies and a user-friendly trading platform.

Wallets are a Good Investment Protection Measure

You must safeguard your cryptocurrency funds in the digital age. Think about the following wallet choices and security measures:

- Hardware Wallets: Use hardware wallets like Ledger or Trezor, which provide offline storage and enhanced security.

- Software Wallets: Choose reputable software wallets like Exodus or Atomic Wallet, ensuring they have strong security features.

- Two-Factor Authentication: For an additional layer of security, enable two-factor authentication (2FA) on your exchange and wallet accounts.

- Keep Your Private Keys Safe: Avoid sharing your private keys with anyone and keep them in a safe offline location.

- Regularly Update Software: Keep your wallet software and antivirus programs up to date to protect against potential vulnerabilities.

Tips for Successful Crypto Trading

To raise your chances of success when trading cryptocurrency, think about putting this advice into action:

- Start with Small Investments: Start small and grow your investment gradually as you acquire confidence and experience.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies to mitigate risks.

- Stay Informed: Continuously educate yourself about the cryptocurrency market, new projects, and industry trends.

- Use Demo Accounts: Practice trading with demo accounts offered by some exchanges to hone your skills without risking real money.

- Follow Reputable Sources: Seek information and insights from reliable cryptocurrency news platforms, forums, and experts.

Common Errors to Avoid

By avoiding common mistakes, you can avoid needless losses and failures in bitcoin trading. Avoid the following risks at all costs:

- Emotional Trading: Letting emotions dictate your trading decisions can lead to impulsive actions and poor judgment.

- Overtrading: Excessive trading can result in increased transaction costs and diminished focus on high-quality trades.

- Failing to Use Stop Loss Orders: Neglecting to set stop loss orders leaves you vulnerable to significant losses.

- Neglecting Research: Failing to conduct thorough research on cryptocurrencies and market trends can lead to poor investment choices.

- Ignoring Risk Management: Neglecting risk management strategies increases the likelihood of substantial losses.

Tracking Your Progress and Making Changes

If you want to see long-term growth, it’s critical to keep track of your trading performance. Here’s how to keep track of your development and implement the necessary adjustments:

- Keep a Trading Journal: Keep track of all of your trades, including entry and exit points, justifications, and results.

- Analyze Your Trades: Review your trading log frequently to spot trends, trading method advantages, and disadvantages.

- Make Adjustments: Based on your findings, adjust your risk management, market approach, or trading plan as necessary.

- Seek Feedback: Engage with the trading community, mentors, or professionals to gain insights and feedback on your performance.

Trading in Crypto and Tax Implications

Trading in cryptocurrencies could have tax repercussions, thus it’s important to comply with all applicable tax laws. Think about the following:

- Consult a Tax Professional: Consult a tax expert who is knowledgeable about the regulations governing the taxation of cryptocurrencies in your country.

- Keep Records: Maintain accurate records of your cryptocurrency transactions, including purchases, sales, and any realized gains or losses.

- Reporting and Filing Taxes: Determine your tax obligations and ensure you report your cryptocurrency trading activities correctly.

- Understand Tax Regulations: Stay informed about the tax regulations specific to cryptocurrency trading in your country.

FAQs

Q1. Can I make $100 a day trading cryptocurrency?

Ans : Yes, Cryptocurrency trading does provide the potential to earn $100 a day, but doing so requires a sound trading strategy, risk management, and ongoing learning.

Q2. How much capital do I need to start trading cryptocurrency?

Ans : Your unique financial condition and level of risk tolerance will determine how much funds you need to begin trading cryptocurrencies. Starting with a sum you can afford to lose is advised.

Q3. Is cryptocurrency trading risky?

Ans : Yes, Due to the market’s turbulence, trading cryptocurrencies does indeed come with inherent dangers. It’s essential that you understand the risks involved and use risk management approaches if you want to keep your wealth safe.

Q4. What are some popular cryptocurrency exchanges?

Ans : Popular cryptocurrency exchanges include Binance, Coinbase, Kraken, Bitfinex, and KuCoin. Conduct thorough research to choose the exchange that best suits your trading needs.

Q5. How can I secure my cryptocurrency investments?

Ans : You can secure your cryptocurrency investments by using hardware wallets, enabling two-factor authentication, keeping private keys safe, and regularly updating software and antivirus programs.

Q6. Should I day trade or swing trade cryptocurrency?

Ans : The choice between day trading and swing trading depends on your trading style, time commitment, risk tolerance, and trading goals.Think about the strategy that best suits your tastes and available resources.

Q7. How do I track my trading performance?

Ans : Keeping a trading journal, analyzing your trades, and seeking feedback from mentors or professionals can help you track your trading performance and make necessary adjustments.

Q8. Are there tax implications for cryptocurrency trading?

Ans : Yes, cryptocurrency trading may have tax implications. To ensure compliance, speak with a tax expert who is knowledgeable with the regulations governing cryptocurrency taxation in your country.

Q9. What are some frequent mistakes to avoid when trading cryptocurrencies?

Ans : Avoid emotional trading, overtrading, neglecting to use stop loss orders, failing to conduct research, and ignoring risk management strategies.

Q10. How do I stay up to date with the bitcoin market?

Ans : Stay informed by following reputable sources such as cryptocurrency news platforms, forums, and experts. Keep yourself informed about market trends and business advancements.

Conclusion

Successfully making $100 a day trading cryptocurrency requires a combination of knowledge, skill, and discipline. Use tools for technical and fundamental analysis, develop a solid trading strategy, and implement effective risk management procedures. Maintain your expertise, continue to learn, and adapt to the bitcoin market’s shifting dynamics. Keep track of your success, learn from your errors, and seek assistance from more seasoned traders. You can successfully navigate the bitcoin trading market and work towards your financial objectives if you are committed and persistent.

Related Articles: