Many of the largest residential REITs (real estate investment trusts) are becoming more popular in the constantly evolving world of real estate investments due to reliable returns and long-term growth potential. These financial instruments are beginning to be more preferred as they enable residential real estate investments without the challenges of home ownership.

In this detailed article, we will move into the largest residential REIT market, highlighting some of the main rivals. So let’s set out on this educational journey together as we explore the world of residential REITs and identify its giants.

Introduction to Residential REITs

Imagine a situation where you can make real estate investments without worrying about buying, managing, or selling property. Residential REITs offer exactly that. Many income-producing real estate properties such as housing development projects, shopping centers, hospitals, and parking garages are the main areas where financial institutions Real estate investment trusts, or REITs do their business. Most REIT investments are made in a variety of land-based structures, including multi-story residential buildings, cell towers, data centers, hotels, office buildings, retail spaces, and warehouses.

What is a REIT?

Let’s commence with the fundamentals. REITs are similar to mutual funds for real estate. Residential REITs are businesses that own, manage, or finance revenue-generating residential buildings. Without buying, managing, or financing any real estate, investors can now profit from real estate investments through REITs.

REITs offer investors significant returns, and unique tax treatments, and are publicly traded on the stock exchange. REITs are obliged to pay shareholders dividends that are at least 90% of their taxable income.

Why Invest in Residential REITs?

Now that we’ve established what a REIT is, you might be contemplating why you should consider investing in residential REITs. Here are several compelling reasons:

# Diversification

If you invest in residential REITs your portfolio can be better diversified which provides the means to invest in the housing market without a home.

# Steady Income

As mentioned earlier, REITs typically offer steady income in the form of dividends. Residential REITs can be a great option if you want consistent cash flow from your investments.

# Professional Management

REITs are under the management of real estate professionals who handle property management, maintenance, and other operational aspects. This relieves you of these responsibilities.

# Liquidity

It’s easier to own REIT shares on the stock market than to own real real estate, which can be less liquid.

The Top Players: Meet the Largest Residential REITs

Meet the Largest Residential REITs Allow me to introduce you to some of the prominent residential REITs that dominate the market and significantly influence the real estate sector:

Equity Residential (EQR)

One of the largest residential REITs in the United States, Equity Residential, commonly known as EQR, is a well-known multifamily housing developer with a large portfolio of apartment buildings across the country.

AvalonBay Communities, Inc. (AVB)

AvalonBay Communities is another major contender in the residential REIT arena. They specialize in the construction, renovation, and administration of apartment complexes on the East and West coasts of the United States.

Essex Property Trust, Inc. (ESS)

Essex Property Trust is renowned for its concentration on West Coast apartment communities. Their portfolio encompasses a diverse range of properties, from suburban garden-style apartments to urban high-rises.

Mid-America Apartment Communities (MAA)

For those intrigued by investments in the Southeastern United States, MAA might pique your interest. They own and manage apartment communities in desirable markets across the region.

Camden Property Trust (CPT)

Camden Property Trust maintains a formidable presence in Sunbelt states such as Texas and Florida. They have garnered a reputation for offering high-quality apartment living.

UDR,Inc. (UDR)

UDR is a real estate investment trust specializing in luxury apartment buildings. These are some of the major cities where they are well represented: New York, Boston, and Washington, D.C.

American Homes 4 Rent (AMH)

American Homes 4 Rent distinguishes itself among residential REITs by focusing on single-family homes for rent. They boast an extensive portfolio of single-family rental properties across the United States.

Invitation Homes Inc. (INVH)

Similar to American Homes 4 Rent, Invitation Homes concentrates on single-family homes for rent, maintaining a substantial presence in various U.S. markets.

These represent just a selection of the major players in the residential REIT market. Each of them offers distinct investment opportunities catering to different regions and preferences.

How Residential REITs Work?

Now that you’ve been introduced to some key players, let’s delve deeper into the operational dynamics of residential REITs. An understanding of their inner workings can empower you to make well-informed investment decisions.

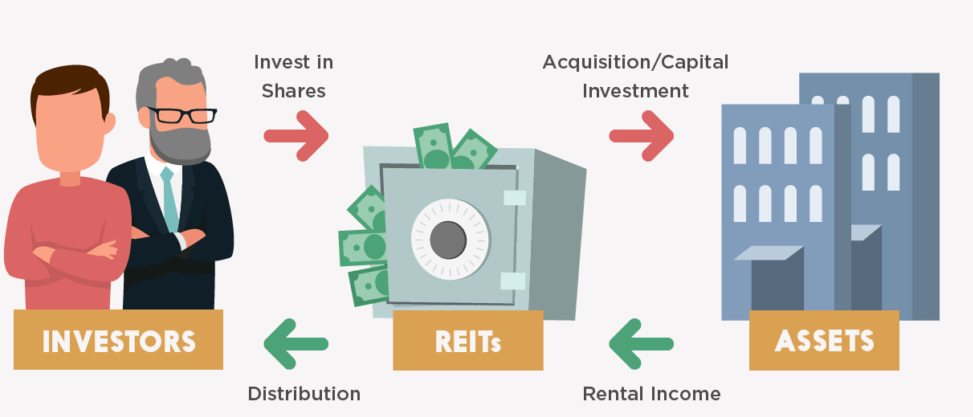

Residential REITs primarily generate income through rent collected from tenants. The dividend payments made to shareholders are made possible by this rental income. Following is a short explanation of the process:

- Property Acquisition: REITs buy pre-existing buildings or construct new ones to acquire residential properties.

- Property Management: They assume responsibility for managing these properties, including tasks such as maintenance, repairs, and ensuring a positive living experience for tenants.

- Rental Income: Tenants pay rent, an important revenue source for REITs.

- Dividend Distribution: REITs often make regular, quarterly dividend payments to shareholders, which account for a large portion of their profits.

- Shareholder Benefits: As a shareholder, you win from these dividends and can profit from potential capital appreciation if the share price of the REIT rises.

It’s crucial to note that REITs are bound by specific tax regulations that necessitate the distribution of a significant portion of their income to shareholders. This unique tax structure contributes to the appeal of REITs due to their attractive dividend yields.

Advantages and Risks of Investing in Residential REITs

Residential REITs have advantages and disadvantages, just like any other investment. Let’s examine what you can expect in more detail.

Advantages:

- Diversification: You can diversify your investment portfolio by buying residential REITs and distributing risk among different real estate market assets.

- Steady Income: Residential REITs are renowned for their consistent dividend payments, making them an attractive choice if you seek a reliable income stream from your investments.

- Liquidity: REIT shares are traded on stock exchanges, providing you with liquidity. You can buy and sell shares with greater ease compared to physical real estate.

Risks:

- Interest Rate Sensitivity: REITs can be sensitive to fluctuations in interest rates. If interest rates increase, the value of current REIT stocks could decrease since they might become less appealing than alternative investments.

- Market Volatility: REIT prices can be subject to market volatility. Economic downturns or fluctuations in the real estate market can influence the performance of REITs.

- Management Quality: The success of a residential REIT hinges on effective property management. Poor management decisions can negatively impact rental income and property values.

Factors to Consider When Choosing Residential REITs

The following are some important factors to keep in mind if you are thinking of investing in residential REITs:

- Location: Evaluate the geographic regions in which the REIT operates. Are they situated in areas with robust rental demand and the potential for property appreciation?

- Property Types: Examine the array of residential properties in the REIT’s portfolio. Do they focus on apartments, single-family homes, or a blend of property types?

- Occupancy Rates: Scrutinize the occupancy rates of the properties. High occupancy rates signify a healthy rental market.

- Dividend History: Review the REIT’s history of dividend payments. Consistently growing dividends can serve as a positive indicator.

- Management Team: Conduct research into the REIT’s management team. An experienced and skilled management team is instrumental in achieving success.

- Financial Health: Analyze the financial statements of the REIT. Look for signs of financial stability and prudent financial management.

- Industry Trends: Stay informed about trends in the real estate market. Shifts in demand, demographic patterns, and economic conditions can influence residential REITs.

Strategies for Investing in Residential REITs

Now that you possess a deeper understanding of what to seek in residential REITs, let’s explore some strategies for investing in them.

- Diversify Your REIT Portfolio: Consider diversifying your investments by including a mix of residential REITs. This diversification can encompass REITs focusing on different regions or property types.

- Reinvest Dividends: Reinvesting dividends can facilitate the growth of your investment over time. Many REITs often offer dividend reinvestment schemes (DRIPs) to their investor enabling automatic reinvestment of dividends.

- Stay Informed: Pay close attention to how the economy and housing markets are performing. You can make wise financial decisions if you keep pace with trends and progress.

- Embrace a Long-Term Perspective: Residential REITs can contribute significantly to long-term investment planning. Put your long-term goals first and don’t let short-term market volatility distract you.

Tax Considerations for REIT Investors

Before delving into residential REIT investments, it’s crucial to comprehend the tax implications. REITs possess a distinctive tax structure that can influence your returns.

REIT dividends are typically categorized as ordinary income for tax purposes and are subject to income tax. Nonetheless, several key points warrant consideration:

- Qualified Dividend Income: A portion of REIT dividends may qualify for lower tax rates, contingent on your overall tax situation.

- Tax-Deferred Growth: REITs can offer tax-deferred growth, as capital gains taxes are deferred until you sell your shares.

- Tax Credits: Some REITs may generate tax credits that can offset other taxes you owe.

To understand how investing in residential REITs may influence your unique tax status, it is advisable to consult a tax expert or financial counselor.

Real Estate Market Trends and Residential REITs

The real estate market is dynamic, with trends exerting influence on the performance of residential REITs. Staying attuned to these trends is indispensable for making informed investment decisions.

- Demographics: Alterations in population demographics can impact the demand for residential properties. For instance, an aging population may drive demand for senior living communities.

- Economic Conditions: Economic factors, including employment rates and wage growth, can influence the rental market. Robust economic conditions often correlate with increased demand for rental properties.

- Technological Advancements: The management and marketing of residential homes may change as a result of technological advancements. The use of technology by REITs can give them a competitive edge.

- Environmental Awareness: Heightened environmental concerns can amplify the demand for energy-efficient and sustainable properties. REITs emphasizing eco-friendly practices may reap benefits.

Common Myths About REITs Answered

Before we conclude this comprehensive guide, let’s debunk some common misconceptions about REITs.

# Misconception 1: REITs Are the Same as Stocks

REITs, although traded on stock exchanges, differ from traditional stocks. They possess, operate, and derive returns from real estate properties through rental income and property appreciation.

# Misconception 2: All REITs Are the Same

Not all REITs are identical. They can focus on distinct property types, regions, and investment strategies. Thorough research is vital to align your choice with your investment goals.

# Misconception 3: REITs Are Always Safe Investments

REITs can provide stable income and diversification, but they also carry some risk. Many factors, such as the state of the economy and the ability to manage, can have an impact on their ability to function.

# Misconception 4: A Large Sum Is Required to Invest in REITs

REITs are accessible to a broad spectrum of investors. You can start with a little investment and grow your portfolio steadily over time.

Conclusion

Finally, residential REITs offer an exceptional opportunity to invest in real estate without having to handle the hassles of home ownership. They attract the interest of different types of investors because they provide security, variety, and liquidity.

As you contemplate delving into residential REIT investments, remember to conduct thorough research, assess your financial objectives, and stay informed about market trends. Residential REITs have the potential to increase the value of your investment with careful planning and a long-term perspective.

FAQs

Q1. What are the largest residential REITs?

Ans: The largest residential REITs include Equity Residential (EQR), AvalonBay Communities, Inc. (AVB), Essex Property Trust, Inc. (ESS), Mid-America Apartment Communities (MAA), and Camden Property Trust (CPT).

Q2. How do residential REITs generate income?

Ans: Residential REITs generate income primarily through rental payments from tenants living in their properties. Dividends are subsequently given out to shareholders from this rental income.

Q3. Can I start investing in residential REITs with a small amount of money?

Ans: Yes, a wide variety of investors can purchase residential REITs. You can begin with a little investment and progressively expand your portfolio over time.

Q4. How are REIT dividends taxed?

Ans: REIT dividends are typically considered ordinary income for tax purposes and are subject to income tax. However, some portions of REIT dividends may qualify for lower tax rates, depending on your overall tax situation. It is advisable to seek out individualized guidance from a tax expert.

A lucrative approach to participate in the real estate industry and make money is by investing in residential REITs. When making investment selections, keep in mind to exercise due diligence and take your financial objectives and risk tolerance into account.

You May Also Like…